On-Chain Data Shows $3.7M BTC Transfers Between Coinbase Wallets — Likely Internal Rebalancing, Not Whale Sell-Off

Arkham data shows multiple 40.3 BTC ($3.7M) transfers between Coinbase wallets, suggesting internal rebalancing — not whale dumping. Analysts urge caution but no panic.

No reason to panic — but definitely a reason to watch.

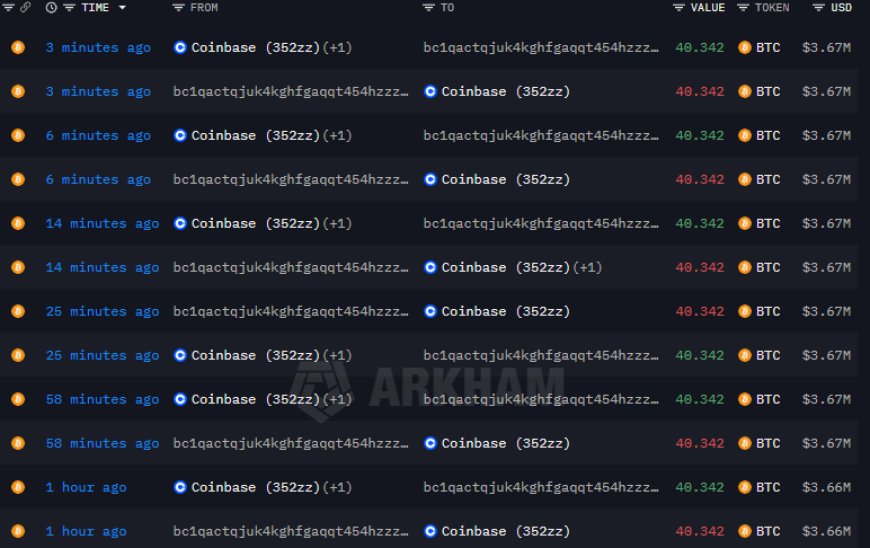

According to on-chain analytics from Arkham Intelligence, a series of repeated 40.342 BTC (~$3.67 million) transactions have been spotted moving between Coinbase-linked wallets in the past hour.

At first glance, such consistent movement might raise alarm bells — especially during volatile market phases — but blockchain analysts say it’s likely internal rebalancing activity, not external whale selling.

What the On-Chain Data Shows

The pattern includes multiple identical transactions between two Coinbase-controlled addresses, occurring within minutes of each other.

Each transfer moved precisely 40.342 BTC, totaling over $30 million in transaction volume within a short timeframe.

“This is classic internal cold-to-hot wallet rotation — not a sign of Bitcoin being sold,” one Arkham data analyst noted.

These internal transactions usually represent exchange fund management, liquidity balancing, or infrastructure testing — all standard procedures for major exchanges.

Image from : https://intel.arkm.com/

Why It’s Not Whale Selling

Whale sell-offs typically involve large outbound transfers from exchange wallets to unknown addresses, signaling that funds are leaving the platform — often a bearish signal.

In this case, however:

- The sending and receiving wallets are both Coinbase-linked, confirmed via on-chain metadata.

- There’s no net outflow of BTC from Coinbase wallets.

- The transfers are consistent in size and timing, matching automated rebalancing behavior.

“When funds stay within exchange clusters, it’s more logistics than liquidation,” one analyst explained.

Market Context

The movements come as Bitcoin trades near $48,300, holding steady amid broader consolidation in the crypto market.

No significant outflow spike has been detected from Coinbase, suggesting liquidity stability rather than capital flight.

Institutional investors and algorithmic traders often monitor such data to assess exchange solvency and flow health, as large outflows typically precede selling pressure.

For now, on-chain sentiment remains neutral.

Outlook: Watch Net Outflows, Not Internal Shifts

Exchange-based wallet activity often sparks speculation — but context matters.

So far, all signs indicate routine fund movement, not market manipulation or whale exits.

In short: stay calm, stay observant, and keep watching those outflow metrics.