Understanding Curve Finance: Guide to the OG DeFi Liquidity Protocol

Curve Finance is a leading protocol in DeFi for low-slippage stablecoin trading and efficient liquidity provision.

Curve Finance has established itself as a cornerstone in the decentralized finance (DeFi) ecosystem. Known for its innovative approach to liquidity and efficient trading, Curve Finance offers a range of features that cater to both novice and seasoned investors.

What is Curve Finance?

Curve Finance is a decentralized exchange (DEX) optimized for stablecoin trading. Launched in 2020 by Michael Egorov, Curve Finance uses an Automated Market Maker (AMM) model to facilitate efficient and low-slippage trading of stablecoins and other assets. Unlike traditional exchanges, Curve doesn’t rely on an order book. Instead, it leverages liquidity pools where users can swap assets directly.

How Does Curve Finance Work?

At its core, Curve Finance employs liquidity pools—smart contracts that hold two or more assets in a balanced ratio. Users (liquidity providers) can deposit their assets into these pools, earning fees from trades that occur within the pool. Here’s a step-by-step breakdown of how Curve Finance operates:

- Liquidity Provision: Users deposit stablecoins or other assets into a Curve liquidity pool.

- Trading: Traders swap between assets within the pool, benefiting from low fees and minimal slippage due to Curve's unique AMM design.

- Earning Fees: Liquidity providers earn a portion of the trading fees, as well as potential rewards in the form of CRV tokens, Curve’s native cryptocurrency.

Key Features of Curve Finance

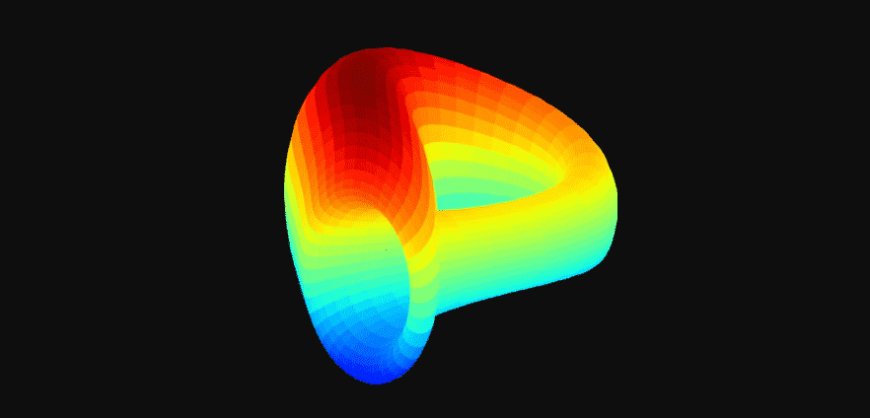

- Low Slippage: Curve Finance is designed to minimize slippage, making it ideal for stablecoin trading. This is achieved through its specialized bonding curves and large liquidity pools.

- Efficient Trading: The platform offers efficient trading with low fees, making it attractive for both traders and liquidity providers.

- CRV Token: The CRV token is used for governance and can be earned by liquidity providers. Holding CRV allows users to vote on important decisions regarding the platform’s future.

- Interoperability: Curve Finance integrates seamlessly with other DeFi protocols, enhancing its utility and accessibility.

Why Curve Finance Matters in DeFi

Curve Finance plays a crucial role in the DeFi ecosystem by providing a reliable and efficient platform for stablecoin trading. Its unique approach to liquidity and low-slippage trading makes it an essential tool for both traders and liquidity providers. Additionally, Curve’s integration with other DeFi platforms enhances the overall functionality and interconnectedness of the DeFi space.

Conclusion

Curve Finance is a pioneering platform in the DeFi landscape, offering low-slippage trading and efficient liquidity provision. Whether you’re a trader looking for cost-effective swaps or a liquidity provider seeking rewards, Curve Finance provides the tools and opportunities to maximize your DeFi experience. As the DeFi ecosystem continues to evolve, Curve Finance stands out as a vital component, driving innovation and efficiency in the market.

By understanding and leveraging Curve Finance, you can take a significant step towards mastering the DeFi landscape and optimizing your investment strategy.

Also read: What is Uniswap (UNI) and How Does It Work?

FAQs

1. What is Curve Finance? Curve Finance is a decentralized exchange (DEX) optimized for stablecoin trading using an Automated Market Maker (AMM) model.

2. How does Curve Finance minimize slippage? Curve Finance minimizes slippage through its unique bonding curves and large liquidity pools designed specifically for stablecoins.

3. What is the CRV token? The CRV token is Curve Finance’s native cryptocurrency used for governance and rewarding liquidity providers.

4. How can I start using Curve Finance? To start using Curve Finance, connect a Web3 wallet like MetaMask, choose a liquidity pool, and deposit your assets.

Embrace the future of decentralized finance with Curve Finance, and explore the potential of efficient, low-slippage trading today.